- TSX-V: NRM

- OTCQB: NRVTF

- Frankfurt: N7R1

Join Our Mailing List

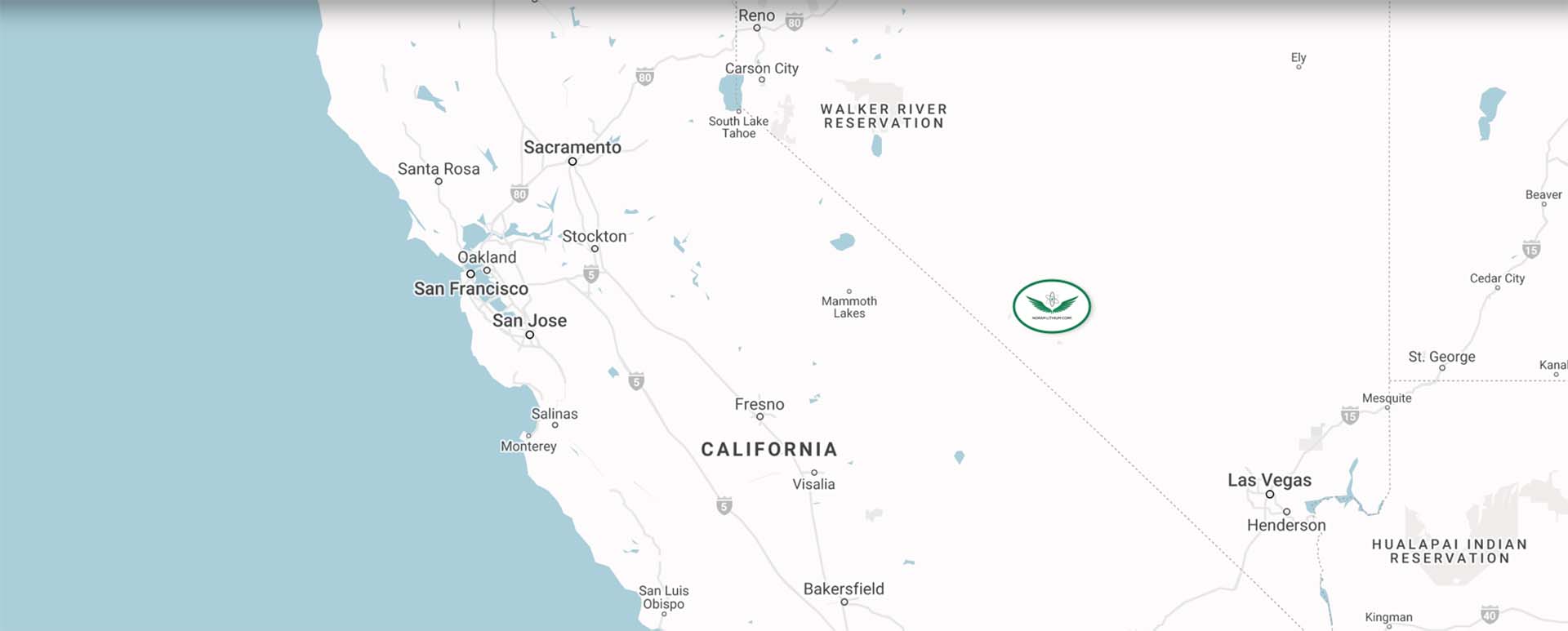

Zeus Property

The Zeus property is approximately halfway between Las Vegas and Reno; and within two kilometers of Albemarle Corporation’s lithium brine producing operations (Silver Peak Mine). The property is comprised of 1,133 hectares which is the equivalent of 2,800 acres.

View MoreRecent News

Feb

25

2026

Noram Adds Additional Critical Mineral to List of High-Value Byproduct Credits in Zeus Project Upgraded PEA

Read More

Aug

18

2025

Noram Lithium Corp. Reports Significant Levels of Critical Metal Cesium and Rubidium Drill Hole Assays from the Zeus Deposit

Read More