The Zeus Lithium Project (Zeus or the Project) in Clayton Valley, Nevada consists of 146 placer claims and 136 lode claims. The land package covers 1,133 hectares (2,800 acres). The perimeter of the Zeus claims are located within 1-mile (1.6 kilometers) of Albemarle Corporation’s (Albemarle’s) lithium brine operations. Lithium is produced at Albemarle’s plant from deep wells that pump brines from the basin beneath the Clayton Valley playa. The plant is the only lithium producer in the United States and has been producing lithium at this location continuously since 1967. Between Albemarle’s operations and Zeus lies a property comparable in size to the Zeus property and held by Century Lithium Corp.

Mineral Resource Estimate (May 2024)

The updated MRE reflects work carried out on the Project in 2023 and 2024, including an updated geological model and a Phase VII drilling program completed in January 2024. The work was designed to improve upon the preliminary mine plan optimization work1 which delineated a significant amount of material over 50% higher grade than the mineral resource grade as a “high-grade core” of the Zeus deposit.

Updated MRE Highlights (Pit Constrained at a 525ppm lithium cut-off):

- Indicated Resources2 of 564 million tonnes grading 956 ppm lithium for 2.9 million tonnes of contained Lithium Carbonate Equivalent (“LCE”).

- Additional Inferred Resources2 of 287 million tonnes at 861 ppm lithium; 1.3 million tonnes of contained LCE

- Constraining pit consists of a high-grade core plus a lower grade peripheral halo.

- Indicated Resources2 within the high-grade core zone of 166 million tonnes grading 1,121ppm lithium, as follows:

|

High Grade Core Zone Indicated Resources2 |

|||

|

Material |

Grade (ppm Li) |

Tonnes |

Grade (ppm Li) |

|

High-Grade |

>1,325 |

54 |

1,496 |

|

Medium Grade |

900-1,325 |

49 |

1,108 |

|

Low Grade |

<900 |

64 |

814 |

|

Total |

|

166 |

1,121 |

- Sufficient high/medium grade Indicated Resources to support 29 years of mine life plus a potential 18 years of processing low-grade, at a nominal processing rate of 3.5 Mt/year.

The updated Mineral Resource statement for the Zeus project shown in table below includes the addition of 10 drillholes and their associated assay data from the Phase VII drilling program, comprehensive geological work including detailed geological mapping, review of historic drillholes and logs, review of literature regarding analogous deposits, the development of an ore deposit model and geological model to synthesize that work, and the collection of 167 density measurements as well as 32 tests of moisture content.

Mineral Resource Estimate Zeus Lithium Project (525ppm Li Cut-off Grade)*

*Resources are contained within a potentially economically minable open pit. Open pit optimization was based on an assumed lithium carbonate equivalent sales price of US$24,000/t (versus long term price forecast of US$30,000/t), process recovery of lithium of 85%, mining costs of US$1.70/wet tonne, processing cost of US$51.52/dry tonne, G&A cost of US$1.00/wet tonne and downstream costs of US$90/dry tonne of refined lithium carbonate. Pit slopes were assumed to be 30°. Average moisture content of the mineralized claystone material at Zeus was measured to be 25%. Lithium Carbonate Equivalent (“LCE”) was calculated suing 5.323 tonnes LCE per tonne of lithium.

As of May 2014, the CIM Standing Committee on Reserve Definitions has defined a Mineral Resource as: A concentration or occurrence of solid material of economic interest in or on the earth’s crust in such form, grade or quality and quantity that there are reasonable prospects for eventual economic extraction. The location, quantity, grade or quality, continuity and other geological characteristics of a Mineral Resource are known, estimated or interpreted from specific geological evidence and knowledge, including sampling. Mineral Resources are not Mineral Reserves and do not have demonstrated economic viability.

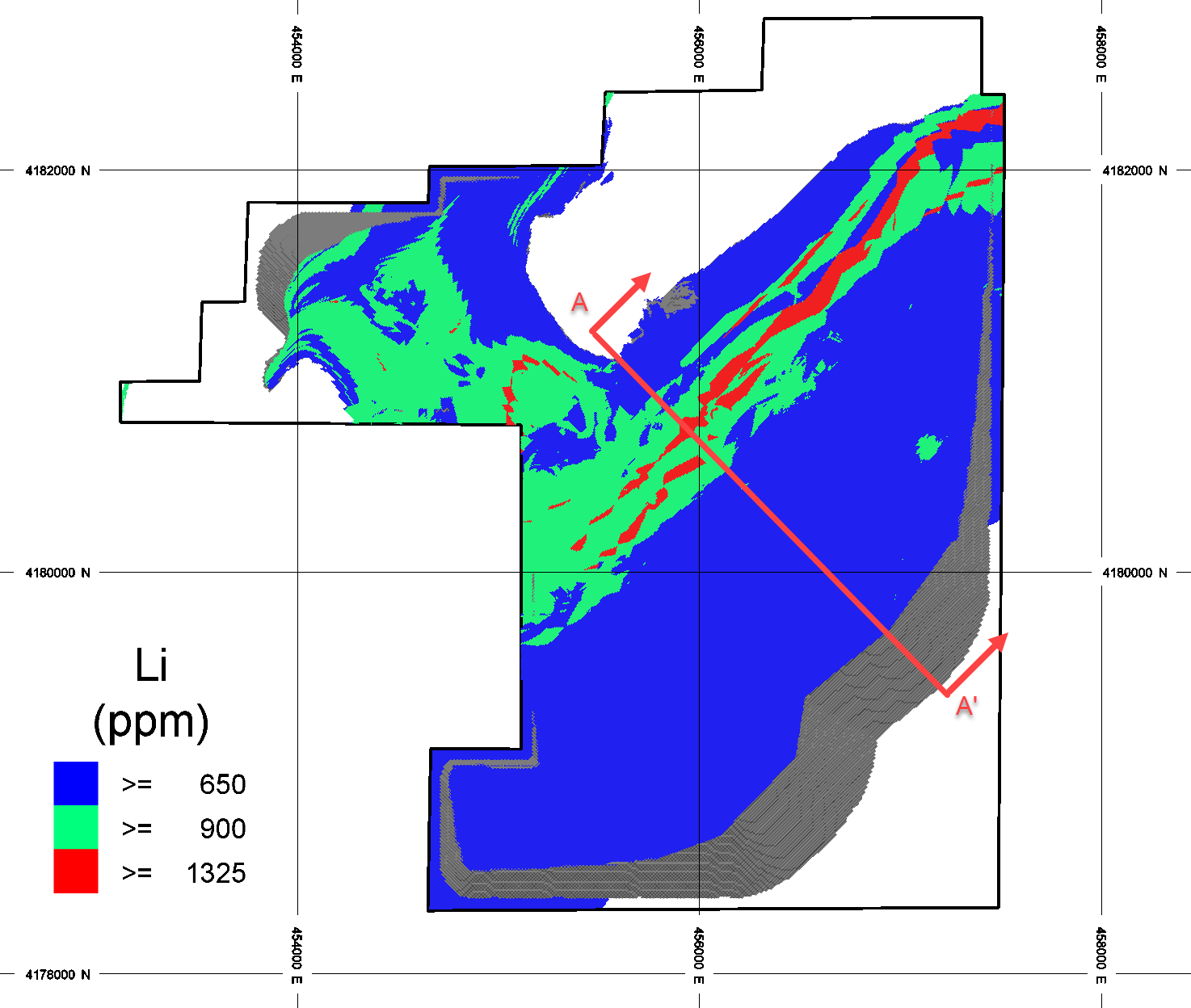

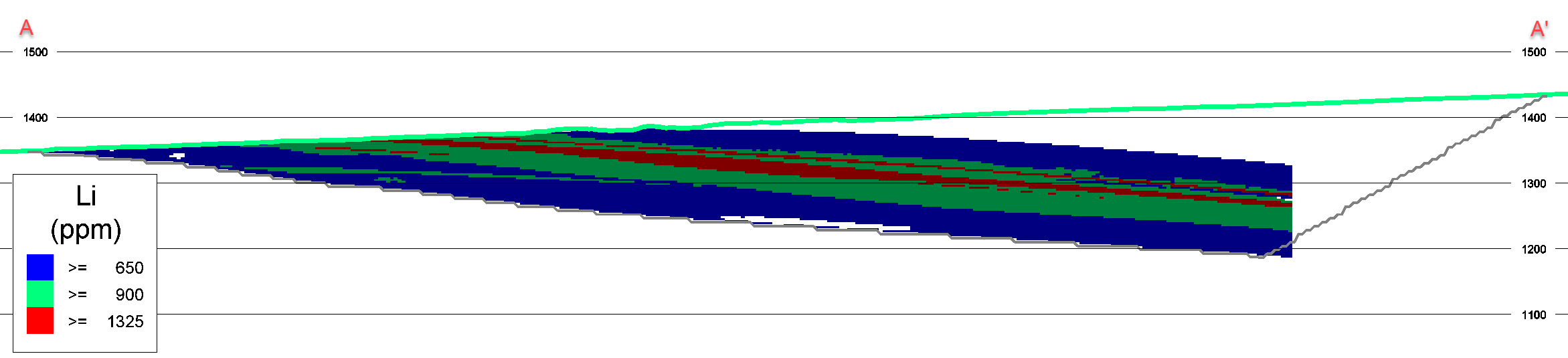

A plan view of the block model and a cross section illustrating the high-grade core zones are shown in the figures below.

Plan view of surface expression of estimated lithium grades in the Zeus block model and constraining pit shell for the Mineral Resource Estimate.

Cross section A- A’ looking northeast of estimated lithium grades, 3-meter sample composite grades and constraining pit shell used for the Mineral Resource Estimate.

Notes

- See news release titled “Noram Lithium Provides Update on Zeus Lithium Project Mine Plan Optimization Work” dated September 6, 2023.

- Mineral Resources are not Mineral Reserves and do not have demonstrated economic viability. There is no certainty that any Mineral Resource will be converted into Mineral Reserve. The Company expects to file an NI 43-101 Technical Report on SEDAR+ no later than July 19, 2024. This news release should be read in conjunction with the Technical Report.

- See news release titled “Noram Lithium Provides Update on Zeus Lithium Project Process Development and Laboratory Testing” dated September 13, 2023.

Mineral Processing and Metallurgical Testing

Following the completion of the Phase VI drill program in May 2022, samples were collected from the Zeus drill core and shipped to Bureau Veritas Laboratories in Richmond, BC. During the period of July 2022 through September 2022, a number of tests were conducted on Zeus samples including: sulphuric acid leaching, hydrochloric acid leaching, roasting, neutralization, impurity removal and solid-liquid separation tests. Based on the test work completed and experience in other industries, the Company has refined the process design for lithium carbonate recovery that is based on known and commercially proven technology.

The Company has engaged Kemetco Research Inc (“Kemetco”), a private sector integrated science, technology and innovation company based in Richmond, BC to carry out further metallurgical test work to confirm and refine the process design. Kemetco have extensive experience in bench scale and pilot scale laboratory studies in lithium extraction.

Proposed Process Description

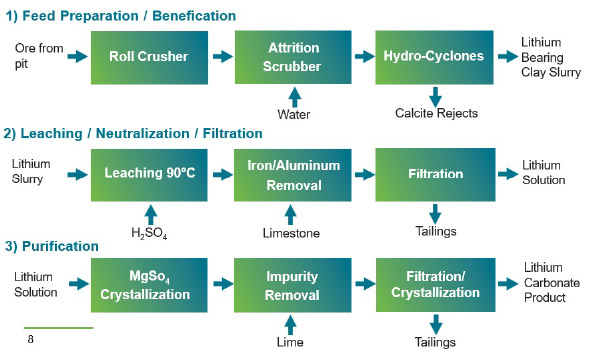

The proposed process consists of three main steps (Figure 1), as follows:

- Feed Preparation/Beneficiation:

- Mineralized material from the mine is passed through a roll crusher;

- Water is added in an agitated attrition scrubber to produce a slurry, and

- Coarse particles containing calcite are rejected through hyrdocyloning to reduce the acid consumption in the subsequent leaching stage.

- Leaching, Neutralization and Filtration:

- Lithium bearing clays from feed preparation are leached with sulphuric acid in agitated tanks at 90°C;

- Iron and aluminum impurities are removed from the lithium bearing solution using limestone under controlled conditions, and

- Iron and aluminum precipitates are filtered for dry-stacking in a tailings storage facility, minimizing water losses from the process and environmental impact.

- Lithium solution is further purified using known technology from lithium hard rock processing facilities to produce battery quality lithium carbonate for packaging and sale.

Test work is currently underway, initially testing the Feed Preparation/Beneficiation and Leaching, Neutralization and Filtration processes in the proposed flowsheet. It is expected that some testing will also be done on lithium solutions to produce battery quality lithium carbonate. Results of the test work will be used to validate the Company’s metallurgical models and mass/energy balances for the Project.

Simplified Process Flow Sheet