Evaluation of Noram Ventures’ Zeus lithium claystone deposit, Clayton Valley, Nevada

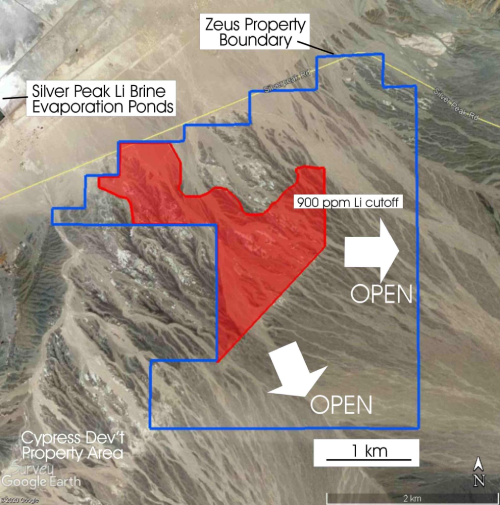

Noram Ventures (NRM-X – listed on Vancouver stock exchange) has a large lithium claystone deposit in Clayton Valley Nevada, adjacent to North America’s only lithium producer: Albemarle’s Silver Peak lithium brine operations (Fig. 1). The Zeus lithium deposit has been drilled over the past 2.5 years, and has indicated and inferred resources that combined total 202 million tonnes, at surface and to a depth of 75-100 meters. The material is unlithified, meaning it does not require blasting for extraction. It has an average grade of 1102 ppm lithium, or 0.59% lithium carbonate (Li¬2CO3) equivalent (“LCE”), for a total of 1.18 million tonnes LCE. Lithium carbonate (99.5% pure) market rates are currently at $US7.25/kg, making for an in-situ resource of $US 8.56 billion. There is ample room to expand the resource on the Zeus property, with only ~50% of the area explored with drilling. At present, Noram’s market cap is $CAD 4-5 million.

Noram’s other neighbor in Clayton Valley is Cypress Development, with the Dean lithium claystone deposit to the south. Cypress is farther along with their Dean exploration and development, and they recently put out a Preliminary Feasibility Study that includes detailed engineering studies, including successful processing of the lithium claystone. In most respects, the Dean deposit is similar to Noram’s Zeus deposit, as the two deposits are within the same Esmeralda Formation playa lake sediments of mid-Miocene to mid-Pliocene age. The deposits are comprised of clay minerals (smectite and illite) that contain the lithium, and lesser amounts of quartz, feldspar, chlorite and amphibole, largely as detrital minerals. Cypress’ economic studies indicate a favorable after-tax NPV (8% discount of >$US 1 billion, and an internal rate of return of 25.8%. Cypress’ present market cap is ~$CAD 30 million.

Also near Noram’s Zeus deposit is American Lithium’s TLC lithium claystone deposit, which is located ~40 km to the northeast (~25 km NW of Tonapah, Nevada). Recently, American Lithium released the maiden resource estimate for TLC, which is ~2.5x larger than Zeus at present, and slightly higher grade. TLC has a total of 5.93 million tonnes LCE in all resource categories. American Lithium has initiated engineering and chemical studies, and like Zeus, their claystone is non-refractory, meaning the lithium can be liberated in low-pH solutions. At present, American Lithium has a market cap of ~$CAD 100 million.

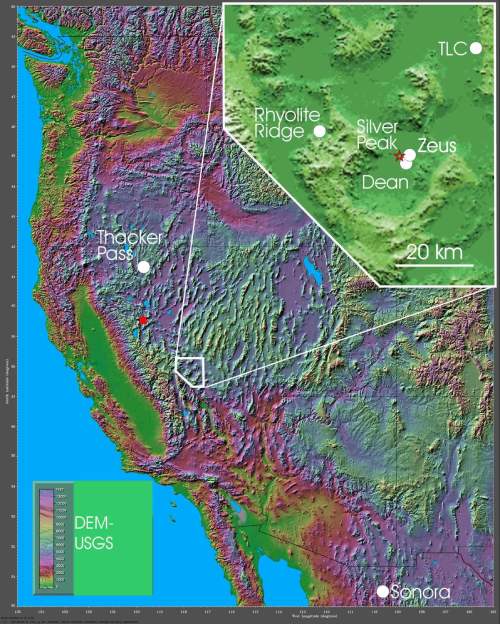

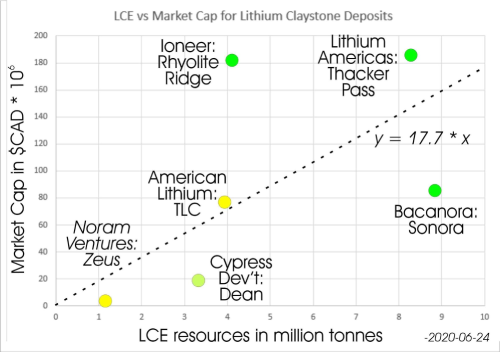

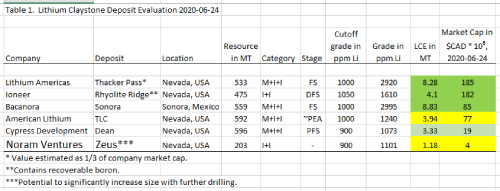

These three deposits/companies are compared located along with three other lithium claystone deposits in the Western USA and northern Mexico in figure 2, and are compared in a broad economic sense in figure 3. The resources for these six deposits are given in table 1, drawing from the company websites given in the references.

Lithium is a principal component in lithium ion batteries used in electric vehicles, laptop computers and cell phones. The demand or lithium is expected to rise significantly with the global demand for electric vehicles, tipping the market into a deficit in late 2022 to early 2023 (J. Lowry, lithium market expert, 2020-07-04).

Figure 1. Noram Ventures’ Zeus lithium claystone deposit outlined by 900 ppm cutoff. Note the deposit is open to the east and south and northeast. The Zeus deposit has 1.18 million tonnes of lithium carbonate equivalent in non-refractory claystones at surface in indicated and inferred resources.

Figure 2. Location of six major lithium claystone deposits in the western USA and northern Mexico. The Silver Peak lithium brine operations are shown as a red star in the inset map, and the Tesla Gigafactory next to Sparks, Nevada is shown as the red box in the main map.

Figure 3. Lithium carbonate equivalent (LCE) resources versus market cap for six lithium claystone deposits in the western USA and northern Mexico. Yellow – resource calculation stage; light green – prefeasibility stage; green: feasibility stage. Note that Noram Venture’s Zeus lithium claystone deposit is defined over only half the Zeus property, and has high potential for expansion to the east and south. The correlation line indicates that for every rise of 1 million tonnes contained LCE, there is a rise of $CAD 17.7 million in market cap on average for lithium claystone projects.

Table 1. A comparison of the grade and tonnage of six lithium claystone deposits in the western USA and northern Mexico. PEA – Preliminary Economic Assessment Study level; PFS – Preliminary Feasibility Study level; FS- Feasibility Study Level; DFS – Definitive Feasibility Study Level. M+I+I: measured, indicated, inferred resources.

References/websites

www.noramventures.com

www.cypressdevelopment.com

www.lithiumamericas.com

www.americanlithiumcorp.com

www.ioneer.com

www.bacanora.com