Update on Nevada lithium claystone projects

Noram Ventures’ Zeus lithium Claystone deposit is one of four significant deposits on the pathway to production in Nevada.

Another lithium claystone deposit is at Thacker Pass in northern Nevada. Today, Lithium Americas posted 2020-Q1 results for their Thacker Pass lithium claystone project in northern Nevada. The Thacker Pass project is a very large deposit within the McDermitt Caldera, and serves as an example for Noram Venture’s Zeus llthium claystone deposit, as the project is more advanced in terms of processing and economic analysis, with a Definitive Feasibility Study planned for 2020-H2. Lithium Americas reports:

“Thacker Pass Lithium Project (“Thacker Pass”):

- Lithium Americas is abiding by all government restrictions relating to COVID-19 in Nevada, and staff are efficiently working from home.

- Permitting continues as planned, with the Mine Plan of Operations accepted by the Bureau of Land Management (“BLM”) and the Notice of Intent published on January 21, 2020 in the federal register, which started a mandated 365 day requirement for the BLM to complete the permitting process. Major permits are expected to be received by the end of Q1 2021.

- Over 10,500 kg of high-quality lithium sulphate has been produced at the process testing facility in Reno, Nevada prior to the temporary closure of the facility in response to COVID-19 safety measures.

- Third-party vendors continue to engineer and design lithium carbonate and lithium hydroxide evaporator and crystallizer as well as provide performance guarantees and product samples.

- A definitive feasibility study (“DFS”) is being completed with an initial targeted production capacity of 20,000 tonnes per annum (“tpa”) lithium hydroxide and approximately 2,000 tpa lithium carbonate (“Phase 1”); the DFS is on track to be completed by mid-2020.

- The Industrial Company, a division of Kiewit Corporation, is engaged to complete key aspects of the DFS.

- Thacker Pass permitting and DFS costs are expected to be fully funded from available cash on hand.

- The Company is exploring financing options for Phase 1 construction, including the possibility of a joint venture partner at Thacker Pass.”

-https://www.lithiumamericas.com/news/lithium-americas-reports-first-quarter-2020-results-

The Dean-Glory project, owned by Cypress Development Corp., is adjacent to Noram’s Zeus project in Clayton Valley. This project was reviewed by Rick Mills, a prominent analyst in the junior mineral exploration/mining sector. The article, “The most important mine in America” provides an assessment of the USA’s need for developing lithium projects at home, and other strategic metal projects more generally. The article notes that the major auto manufacturers committed to EV production several years ago and are following through with this commitment. There are supply chain shortages for EV lithium ion batteries in Europe, and EV battery manufacturers are expanding capacity to serve the EV auto sector.

Quoting from the article:

“In fact lithium ion batteries are expected to be the fastest-growing energy storage technology, accounting for 85% of newly installed storage capacity, and over 28 gigawatts by 2028, according to an analysis by Navigant Research. (there was only 1.4GW in 2017)

The upshot? Total lithium demand of 300,000 tonnes LCE is expected to reach over 1 million tonnes by 2025 or higher, states S&P Global Platts Analytics. Current annual supply is around 360,000 tonnes.

How will the United States obtain enough lithium for the storm of demand that is brewing?

The US only produces 1% of global lithium supply and 7% of refined lithium chemicals, versus China’s 51%. The country is about 70% dependent on imported lithium.

To lessen US lithium dependency will require the building of a mine to battery to EV supply chain in North America.

The first step is to develop new North American lithium mines.

Currently the only US lithium producer is chemicals giant Albemarle. Lithium products from Albemarle’s Silver Peak lithium brine operation in Nevada are sent to its processing plant in North Carolina. This material is then loaded on ships and sent to Asian battery manufacturers, which sell the batteries to automakers.

According to Visual Capitalist Albemarle’s Silver Peak lithium mine only produces enough lithium to produce roughly 1,000 tonnes per year of lithium hydroxide, within a current lithium market of roughly 360,000 tonnes per annum of lithium carbonate equivalent (LCE), a term that encompasses both lithium hydroxide and carbonate used in EV batteries.

There’s no way Silver Peak can produce enough lithium to supply American needs, especially with all of the EV battery and auto production facilities planned.

Fortunately, there are other deposits in Nevada that lithium companies are racing to develop. One of them is held by Cypress Development Corp.”

Also:

“Last year Cypress Development Corp completed the first two phases of a prefeasibility study (PFS) at its Clayton Valley Lithium Project in Nevada - confirming that lithium can be acid-leached and extracted at high recovery rates and successfully separating the lithium-rich claystone ores from the sulfuric acid leachate.

It’s a major technical problem to separate ultra-fine clay particles (<5 microns) from a leach solution. Cypress has done it, putting the company at the forefront of lithium clay projects globally.

The US now has a major source of lithium carbonate and lithium hydroxide and potentially a not-inconsiderable amount of rare earths including scandium - a highly prized metal used in aircraft components, for example.

The eagerly-awaited prefeasibility study is crucial to moving the project forward, not only for proving that the metallurgical process for separating lithium from clays is commercially viable, but demonstrating that Cypress’ costs are in line with the 2018 preliminary economic assessment (PEA).

The mine

Cypress’ vision is to build a mine with the ability to extract whatever oxides they choose, from the processing plant. The project design is based on mining 15,000 tonnes per day to produce 25,000 tonnes per year of LCE.

The end result is that through by-product credits Cypress could shave millions of dollars off of their processing costs - further enriching what we already think is looking to be a very profitable mine.

The mine would be neither a hard-rock nor a lithium brine operation, but rather, would process lithium from clays in Nevada’s Clayton Valley by leaching with sulfuric acid.

Picture the operation as a sulfuric acid plant with an open pit on one side, on the other side is a processing plant. Sulfuric acid produced from elemental sulfur in the acid plant is combined with water and claystone from the pit in heated agitated leach tanks. Solid particles are then separated and the leach solution goes into the lithium recovery plant where lithium carbonate or lithium hydroxide is the end result. Magnesium, potassium and rare earth oxides - scandium, dysprosium and neodymium - are potentially recovered out of the leach solution along the way.

The completion of the prefeasibility study’s first phase, in early 2019, confirmed that lithium can be acid-leached with lithium extraction and sulfuric acid consumption in line with the estimates in the PEA. The tests also showed impurities such as magnesium - which can significantly increase the complexity and costs of processing lithium - are controlled through conventional processing.

The second stage of the PFS, completed last August, successfully separated solids from liquids, and simplified the flowsheet that will be used to develop lithium products on a commercial scale. According to CEO Bill Willoughby, the changes in the process changed the chemistry of the leachate such that more testing was needed.

Cypress thus hired NORAM Engineering to conduct further work on lithium recovery.

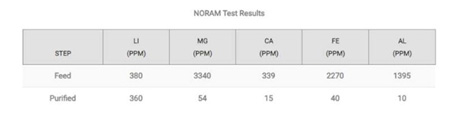

The results of NORAM’s test program, presented below, are great. Starting with a feed of 380 parts per million (ppm), using Cypress’ flowsheet, NORAM was able to strip out the impurities to low levels of magnesium, calcium, iron and aluminium and end up with a solution of 360 ppm lithium. Says Willoughby, “we were quite pleased with these results, which represent the first of three stages in lithium recovery that NORAM tested. This stage confirmed we can easily and cheaply produce a clean lithium solution. The next two stages, which NORMAM has completed, will show how the lithium concentrates as water and sodium are removed.

Cypress is waiting on the final report from NORAM, but Willoughby is confident in the process based on the results so far. “Based on the solution grades we see after purification, the steps to reaching battery-grade product are predictable and industrially proven. The work throughout the PFS addressed the risk areas identified in the PEA and successfully found solutions to problems we encountered along the way.”

-www.investorideas.com/news/2020/main/03318RichardMills-America.asp