Noram Announces New Resource Estimate for Zeus Lithium Deposit Preliminary Economic Assessment Underway and in Final Stages

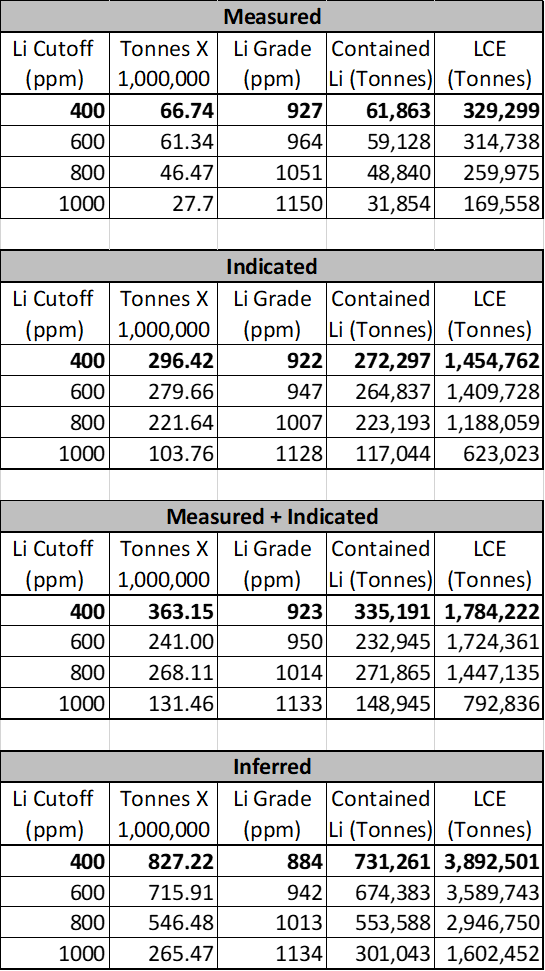

Vancouver, British Columbia – September 21, 2021 – Noram Lithium Corp. (“Noram” or the “Company”) (TSX - Venture: NRM / Frankfurt: N7R / OTCQB: NRVTF) announced a new resource estimate, following the Phase V drill program on the Zeus lithium claystone property located within 2km of Albemarle’s Silver Peak lithium mine in Clayton Valley, Nevada. At a 400 ppm lithium cut-off, the Zeus deposit now has 363 million tonnes at 923 ppm lithium measured + indicated resources, and 827 million tonnes lithium at 884 ppm lithium inferred resource. A substantial increase in the resource size.

“Today’s announcement marks the single most impactful event in the Company’s lifecycle,” stated Sandy MacDougall, Noram Lithium’s Chief Executive Officer. This new resource estimate conveys the scale we have known existed and reports the cutoff of 400 ppm, in-line with peer lithium companies who are highly valued against that metric.” Mr. MacDougall went on to say, “With the current lithium carbonate price moving higher than $24,000 USD per tonne this month and growing demand from the growing global EV and battery markets, Noram is well positioned from a North American in-situ standpoint to take advantage of geological and geographical advantages. We look forward to publishing our PEA in the coming weeks.”

Highlights

- Large Resource Size Increases.

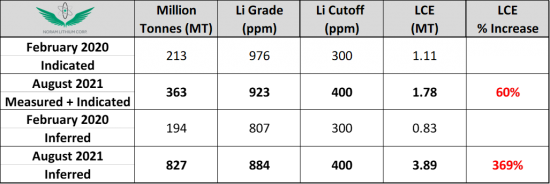

- 70% Increase in Measured + Indicated Resources - In February 2020, Noram reported an indicated resource of 213 million tonnes at 976 ppm Li (LCE = 1.11 million tonnes) at a cut-off grade of 300 ppm. The updated 2021 Measured + Indicated Resources is 363 million tonnes at 923 ppm Li at cut-off of 400 ppm (LCE = 1.78 million tonnes). That is a measured + indicated tonnage increase of 70% and an LCE increase of 60% at a higher cut-off grade than the one used in 2020. Some of the resources have also been upgraded from indicated to measured.

- 369% Increase in Inferred Resources - The 2020 announcement had an Inferred resource of 194 million tonnes at 807 ppm (LCE = 0.83 million tonnes) at a 300 ppm cut-off. The 2021 inferred resource is calculated at 827 million tonnes at 884 ppm Li (LCE = 3.89 million tonnes) at a 400 ppm cut-off. This represents an increase in the inferred resource tonnage of 326% and a 369% LCE increase, also at the higher cut-off grade.

- Near Surface = Low Strip Ratio. The majority of the deposit occurs at or near the surface, greatly reducing mining costs. Preliminary extraction analyses using Rockworks 2021 indicate that the stripping ratio for the 400-ppm cut-off resource would be less than 0.2:1. The strip ratio is similar to the adjacent Cypress Development Corp.’s Clayton Valley project, considered to be to be part of the same mineral deposit as Noram’s. Cypress projected an industry-low mining cash cost of US$3,387 per tonne LCE, giving the company a US$1.03B NPV at an 8% discount rate with a US$9,500 LCE $/t.

- Open at Depth. There is potential to increase the deposit size through further deeper drilling, as 55 of the total 70 holes used in the deposit model ended in mineralization that assayed above the 400 ppm Li cutoff.

- Environmental Footprint. Preliminary testing for the extraction of the lithium from the mined material has indicated that the material will be relatively inexpensive to process. The type of processing envisioned will have a much smaller footprint than lithium brine operations, which now employ large evaporation ponds, making Noram’s proposed operation more environmentally friendly.

- Preliminary Economic Assessment (PEA). The results contained in the updated resource estimate report has enabled the Company to undertake a PEA. The PEA is in its advanced stages and will be published in the forthcoming weeks.

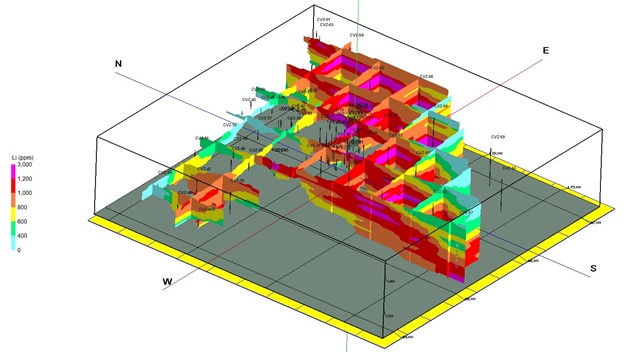

Figure 1 - Fence diagram looking northeast. Colours represent Li grades as indicated on the left.

Table 1. Zeus lithium deposit resource estimate, 2021-09

Table 2. Zeus Project - Increase in Resource Size Following the Phase V Drilling Program

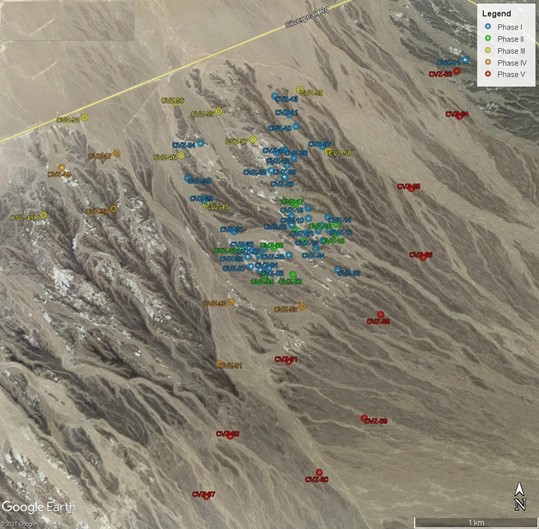

Figure 2. The 5 phases of drilling, color-coded by phase.

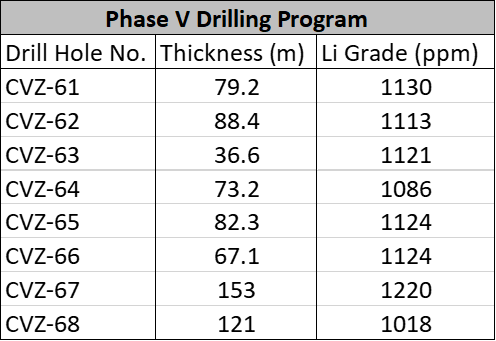

Table 3. Phase V Drilling Highlights

The technical information contained in this news release has been reviewed and approved by Brad Peek., M.Sc., CPG, who is a Qualified Person with respect to Noram’s Clayton Valley Lithium Project as defined under National Instrument 43-101.

About Noram Lithium Corp.

Noram Lithium Corp (TSX - Venture: NRM / Frankfurt: N7R / OTCQB: NRVTF) is a Canadian-based junior exploration company, with a goal of developing lithium deposits and becoming a low - cost supplier. The Company’s primary business is the Zeus Lithium Project (“Zeus”) in Clayton Valley, Nevada. The Zeus Project has a current resource estimate of 400 ppm lithium cut-off, the Zeus deposit now has 363 million tonnes at 923 ppm lithium measured + indicated resources, and 827 million tonnes lithium at 884 ppm lithium inferred resources (400 ppm Li cut-off).

Noram’s long-term strategy is to build a multi-national lithium minerals company to produce and sell lithium into the markets of Europe, North America and Asia.

Please visit our web site for further information: www.noramlithiumcorp.com.

ON BEHALF OF THE BOARD OF DIRECTORS

Sandy MacDougall

President, CEO and Director

Investor Relations Contact:

Rich Matthews

Managing Partner

Integrous Communications

rmatthews@integcom.us

+1 604 757 7179

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release. This news release may contain forward-looking information which is not comprised of historical facts. Forward-looking information involves risks, uncertainties and other factors that could cause actual events, results, performance, prospects and opportunities to differ materially from those expressed or implied by such forward-looking information. Forward-looking information in this news release includes statements regarding, among other things, the completion transactions completed in the Agreement. Factors that could cause actual results to differ materially from such forward-looking information include, but are not limited to, regulatory approval processes. Although Noram believes that the assumptions used in preparing the forward-looking information in this news release are reasonable, including that all necessary regulatory approvals will be obtained in a timely manner, undue reliance should not be placed on such information, which only applies as of the date of this news release, and no assurance can be given that such events will occur in the disclosed time frames or at all. Noram disclaims any intention or obligation to update or revise any forward-looking information, whether as a result of new information, future events or otherwise, other than as required by applicable securities laws.