Noram Lithium Announces Significant Increase In Mineral Resources At The Zeus Lithium Deposit

Vancouver, British Columbia – January 30, 2023 – Noram Lithium Corp. (“Noram” or the “Company”) (TSXV: NRM | OTCQB: NRVTF | Frankfurt: N7R) announces a significant increase in its estimated mineral resources at the Zeus Lithium Project, following the completion of the Phase VI drill program during the second quarter of 2022 (see Table 1 for the 2022 phase VI drill highlights).

Highlights of the Updated Resource Estimate

- An increase of 190% in Measured and Indicated (“M&I”) lithium carbonate equivalent (“LCE”) Resources from the August 2021 Mineral Resource Estimate.

- M&I Resources increased to 5.17 million tonnes (“Mt”) LCE (1,034 Mt at 941 parts per million lithium (“ppm Li”)) at a 400 ppm Li cut-off grade.

- Substantial Inferred Resources remain from the 2022 Phase VI drill program.

- Inferred Resources are 1.09 Mt LCE (235 Mt at 871 ppm Li) at a 400 ppm Li cut-off grade.

- Near Surface = Low Strip Ratio. The majority of the deposit occurs at or near the surface, resulting in relatively low mining costs. Results from the Preliminary Economic Study (“PEA”)1 indicate that the life of mine strip ratio would be ~0.07:1 (waste:ore).

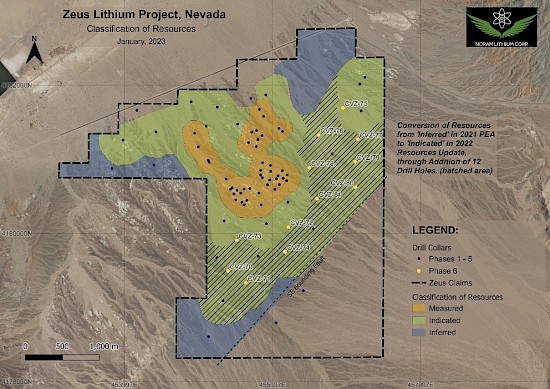

- High level of confidence in the deposit modelled given the density of the drill program with 82 holes drilled to-date. All holes were core holes for more precise sampling and stratigraphic correlations.

- High grade core (60 meters thick x 1.2 kilometers wide x 3.0 kilometers long) represents an opportunity for optimizing the mine plan. At a 1,200 ppm Li cut-off the Measured and Indicated Resources total 1.2 Mt LCE (169 Mt at 1,326 ppm Li).

“The updated mineral resource estimate, with 82 drill holes completed to-date, highlights that Noram’s Zeus Lithium Project is exceptionally well positioned in the United States amongst its peer deposits in terms of grade and contained Lithium Carbonate Equivalent,” stated Greg McCunn, Noram’s CEO. “The high-grade core of the deposit outcropping at surface provides a significant opportunity to optimize the project mine plan and enhance value. With a strong treasury and a strengthened technical team, we are expecting to move aggressively in 2023 to further de-risk the project with continued metallurgical testing and completion of a Prefeasibility Study.”

Table 1. Zeus Project – 2022 Phase VI Drill Highlights (Previously reported)

| Phase VI Drilling Highlights | ||

| Drill Hole No. | Thickness (m) | Li Grade (ppm) |

| CVZ-70 | 135.0 | 1011.7 |

| Including | 110.6 | 1067.9 |

| Or | 67.1 | 1267.3 |

| CVZ-71 | 85.3 | 1050.0 |

| Including | 24.4 | 1203.1 |

| CVZ-72 | 112.2 | 1120.9 |

| CVZ-77 | 73.2 | 1212.1 |

| CVZ-78 | 70.5 | 1157.1 |

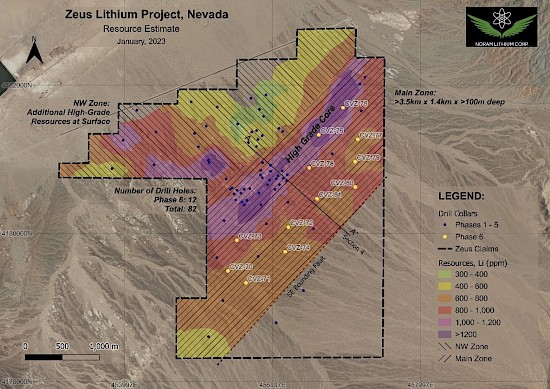

The Phase VI drilling as shown in the table below converted a significant amount of resources from Inferred to Measured and Indicated and increased the overall size of the resource.

Table 2. Zeus Project - Increase in Resource Size Following the Phase VI Drilling Program

| Resource Model Comparison 2021 vs 2023 |

Million Tonnes (MT) |

Li Grade (ppm) |

Li Cutoff (ppm) |

LCE (MT) |

LCE % Increase |

| August 2021 Measured & Indicated | 363 | 923 | 400 | 1.78 | |

| January 2023 Measured & Indicated | 1,034 | 941 | 400 | 5.17 | 190% |

| August 2021 Inferred | 827 | 884 | 400 | 3.89 | |

| January 2023 Inferred | 235 | 871 | 400 | 1.09 | (72%) |

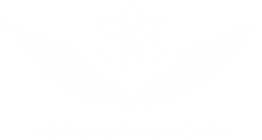

The Zeus Lithium Project as shown below has a higher-grade core to the deposit which outcrops at surface. Mine plan optimization is currently underway looking at options for a smaller high-grade pit which could support a 15-20 year mine life.

Figure 1 – Resource Model Plan View; colours represent Li grades as indicated on the right.

As shown in Figure 2 the Phase VI drilling provided the drill density to convert previously classed Inferred Resources into Measured and Indicated Resources. The remaining Inferred Resources shown have the potential to be converted into Measured and Indicated Resources with further drilling.

Figure 2 – Resource Classification Plan View; colours represent resource categories

Figure 3 – Section A-A’ Highlighting extensive continuity of high grade lithium sedimentary layers.

The sensitivity to varying Lithium grade cut-offs is shown in the table below.

Table 3. Zeus lithium deposit resource estimate, 2023-01

| Measured | ||||

| Li Cutoff (ppm) |

Tonnes x 1,000,000 | Li Grade (ppm) |

Contained Li (tonnes) |

LCE (tonnes) |

| 400 | 116.24 | 860 | 99,917 | 531,860 |

| 500 | 110.98 | 879 | 97,520 | 519,100 |

| 1000 | 30.62 | 1161 | 35,539 | 189,178 |

| 1200 | 10.71 | 1295 | 13,859 | 73,773 |

| Indicated | ||||

| Li Cutoff (ppm) |

Tonnes x 1,000,000 | Li Grade (ppm) |

Contained Li (tonnes) |

LCE (tonnes) |

| 400 | 917.31 | 951 | 872,162 | 4,642,550 |

| 500 | 901.60 | 959 | 864,942 | 4,604,120 |

| 1000 | 372.46 | 1192 | 443,807 | 2,362,399 |

| 1200 | 157.97 | 1328 | 209,803 | 1,116,791 |

| Measured + Indicated | ||||

| Li Cutoff (ppm) |

Tonnes x 1,000,000 |

Li Grade |

Contained Li (tonnes) |

LCE (tonnes) |

| 400 | 1033.55 | 941 | 972,079 | 5,174,411 |

| 500 | 1012.58 | 951 | 962,462 | 5,123,220 |

| 1000 | 403.08 | 1189 | 479,346 | 2,551,577 |

| 1200 | 168.67 | 1326 | 223,663 | 1,190,564 |

| Inferred | ||||

| Li Cutoff (ppm) |

Tonnes x 1,000,000 | Li Grade (ppm) |

Contained Li (tonnes) |

LCE (tonnes) |

| 400 | 234.90 | 871 | 204,678 | 1,089,508 |

| 500 | 228.65 | 882 | 201,764 | 1,073,998 |

| 1000 | 65.61 | 1115 | 73,165 | 389,462 |

| 1200 | 10.38 | 1268 | 13,157 | 70,033 |

NI 43-101 Compliant Technical Report

The Company expects to file an NI 43-101 compliant technical report on SEDAR no later than March 17, 2023.

Mineral Resource Estimate Preparation

The Mineral Resource estimate has been prepared by Damir Cukor, P. Geo of ABH Engineering in conformity with CIM “Estimation of Mineral Resource and Mineral Reserves Best Practices” guidelines and are reported in accordance with the Canadian Securities Administrators NI 43-101. Mineral resources are not mineral reserves and do not have demonstrated economic viability. There is no certainty that any mineral resource will be converted into mineral reserve.

QA/QC

To ensure reliable sample results, the Company has a rigorous QA/QC program that monitors the chain-of-custody of samples and includes the insertion of blanks and certified reference standards at statistically derived intervals within each batch of samples.

All samples were sent to ISO-17025 accredited ALS Laboratories in Reno, Nevada and North Vancouver, BC for analysis. ALS is a public company listed on the Australian stock exchange and is entirely independent of Noram. All samples were prepared using ALS’ PREP-31 sample preparation process, which is presented in the ALS Fee Schedule as: “Crush to 70% less than 2mm, riffle split off 250g, pulverize split to better than 85% passing 75 microns.” Each sample was then analyzed using ALS’ ME-MS61 analytical method which uses a Four Acid Digestion and MS-ICP technologies. All samples were analyzed for 48 elements. Samples were kept secure until shipped to the ALS lab in Reno, picked up by the ALS lab in Reno or shipped via FedEx to ALS in North Vancouver.

Qualified Persons

The technical information contained in this news release has been reviewed and approved by:

- Damir Cukor, P. Geo., who is an Independent Qualified Person as defined by National Instrument 43-101 Standards of Disclosure for Mineral Projects, with ABH Engineering Inc., consultants to Noram Lithium.

- Brad Peek, M.Sc., CPG, who is a Qualified Person with respect to Noram’s Clayton Valley Lithium Project as defined by National Instrument 43-101 Standards of Disclosure for Mineral Projects, and also Vice President of Exploration for Noram Lithium.

Investor Relations Services

The Company’s News Release dated November 30, 2022 and titled ‘Noram Highlights Milestones During 2022’ stated that Noram had engaged Native Ads, Inc. an arms-length party, to provide investor relations services. The services commenced in December 2022 pursuant to a consulting agreement dated November 23, 2022, and the Company agreed to and paid upfront the fees totaling $90,000 USD for an initial service period of 6 months.

About Noram Lithium Corp.

Noram Lithium Corp. (TSXV: NRM | OTCQB: NRVTF | Frankfurt: N7R) is focusing on advancing its 100%-owned Zeus Lithium Project located in Clayton Valley, Nevada an emerging lithium hub within the United States. With the upsurge in the electric vehicle and energy storage markets the Company aims to become a key participant in the domestic supply of lithium. The Company is committed to creating shareholder value through the strategic allocation of capital and is well-funded to advance through to the Definitive Feasibility Study.

The Zeus Lithium Project contains a current 43-101 measured and indicated resource estimate of 5.2 Mt LCE (1034 Mt at 941 ppm lithium), and an inferred resource of 1.1 Mt LCE (235 Mt at 871 ppm lithium) utilizing a 400 ppm Li cut-off.

In December 2021, a robust PEA1 indicated an After-Tax NPV(8) of US$1.3 Billion and IRR of 31% using US$9,500/tonne Lithium Carbonate Equivalent (LCE). The PEA indicates an After-Tax NPV (8%) of approximately US$2.67 Billion and an IRR of 52% at US$14,250/tonne LCE. Note that the current daily prices have increased to over US$70,000/tonne LCE.

Please visit our web site for further information: www.noramlithiumcorp.com.

ON BEHALF OF THE BOARD OF DIRECTORS

Sandy MacDougall

Founder and Chairman

C: 778.999.2159

For additional information please contact:

Greg McCunn

Chief Executive Officer

greg@noramlithiumcorp.com

C: 778.991.3798

Footnote

1 Preliminary Economic Assessment Zeus Project, ABH Engineering (December 2021).

Cautionary Statement Regarding Forward Looking Information

This news release may contain forward-looking information which is not comprised of historical facts. Forward-looking information involves risks, uncertainties and other factors that could cause actual events, results, performance, prospects and opportunities to differ materially from those expressed or implied by such forward-looking information. Forward-looking information in this news release includes statements regarding, among other things, the intended timing for filing of a technical report in respect of the Zeus Lithium Project, intended testing and project work to completed in 2023 and the potential to complete a prefeasibility study for the project. Factors that could cause actual results to differ materially from such forward-looking information include, but are not limited to, the ability of third-parties to complete the preparation work necessary for the filing of a technical report, access to the project and completion of the necessary testing and analysis work to prepare a prefeasibility study and receipt of any required regulatory or governmental approvals in connection with ongoing work on the project. Although Noram believes that the assumptions used in preparing the forward-looking information in this news release are reasonable, including that all necessary regulatory approvals will be obtained in a timely manner, undue reliance should not be placed on such information, which only applies as of the date of this news release, and no assurance can be given that such events will occur in the disclosed time frames or at all. Noram disclaims any intention or obligation to update or revise any forward-looking information, whether as a result of new information, future events or otherwise, other than as required by applicable securities laws.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.