Noram Lithium Corp. Reports Significant Levels of Critical Metal Cesium and Rubidium Drill Hole Assays from the Zeus Deposit

Vancouver, British Columbia – August 18, 2025 – Sandy MacDougall, Chairman of Noram Lithium Corp. (“Noram” or the “Company”) (TSXV: NRM | OTCQB: NRVTF | Frankfurt: N7R) is pleased to report that the Company has completed a full review of the assay data from the Company’s flagship Zeus lithium deposit in Clayton Valley, Nevada. Notably, high results of the critical minerals, Rubidium (Rb) and Cesium (Cs), have the potential for an additional resource of significant economic value.

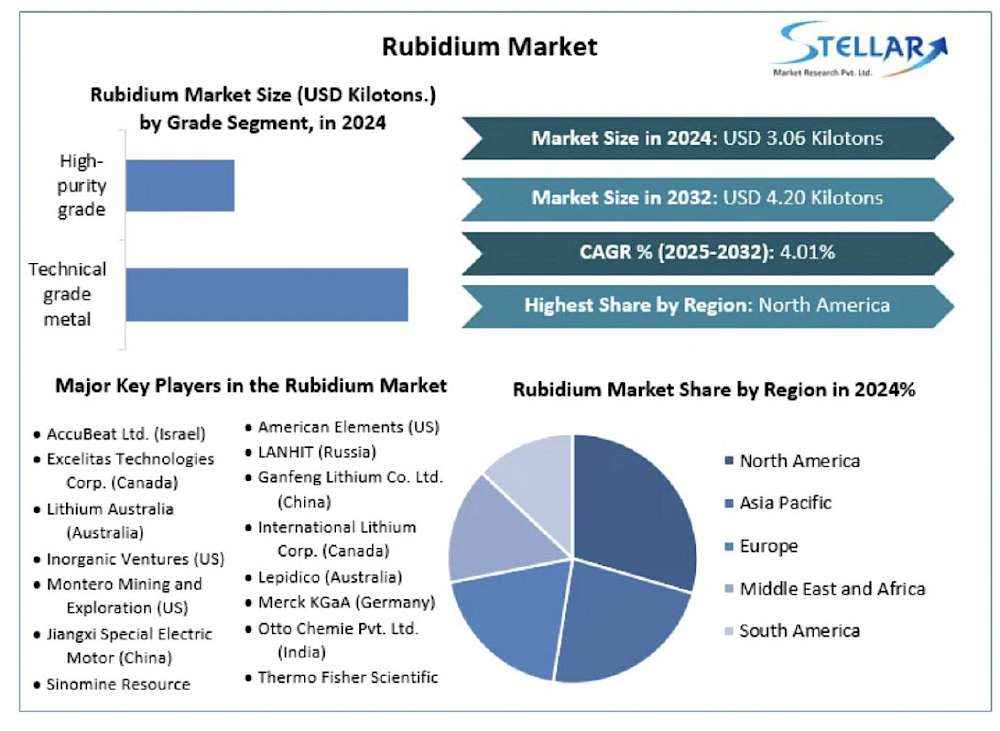

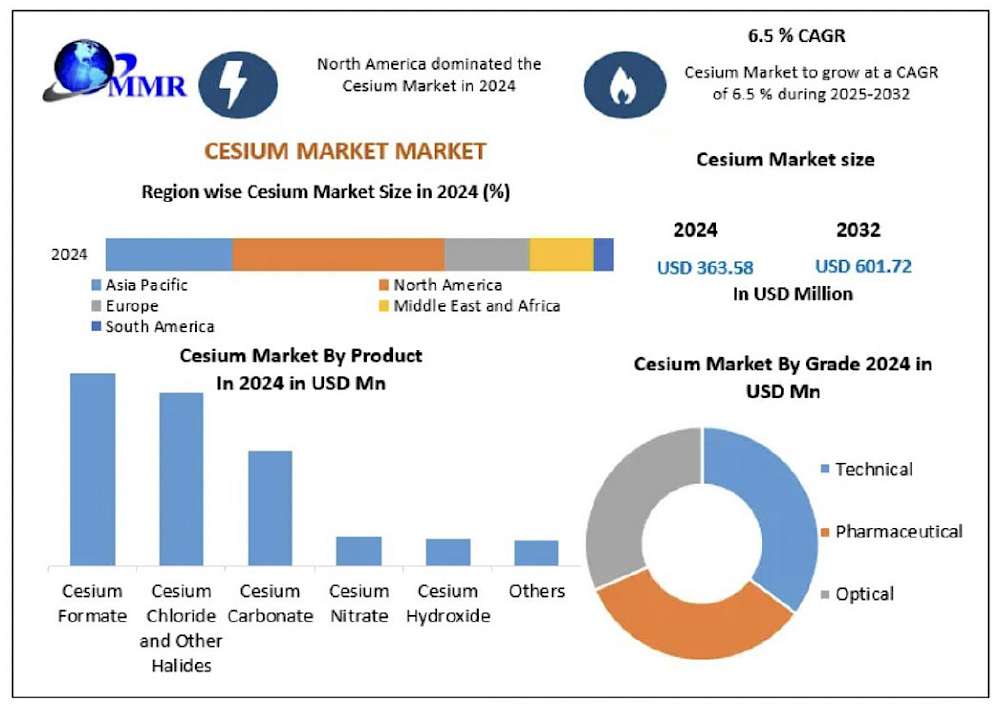

“Rubidium and cesium are rare, strategically important elements mainly sourced as by-products from lithium and pollucite mining. They serve critical roles in advanced electronics, telecommunications, and medical technologies. Their scarcity and specialized demand maintain a high value. Extracting cesium and rubidium as valuable by-products can substantially increase the project’s overall profitability”, stated Sandy MacDougall, Chairman and Director. “As our investors know, relying solely on one commodity can be risky due to market volatility. Having access to cesium and rubidium metals that occur naturally within our project offers a strategic, economic, and political advantage, especially in the context of U.S. efforts to secure critical mineral supplies in markets that are forecasted to almost double in approximately the next 5 years.”

Figure 1 - Cesium Market: Global Industry Analysis and Forecast (2025-2032), February 2025, report ID 89395

Figure 2 - Rubidium Market - Global Industry analysis and Forecast (2025-2032) by Grade segment, Application and Region, March 2025, report ID SMR_1192

Assay Data

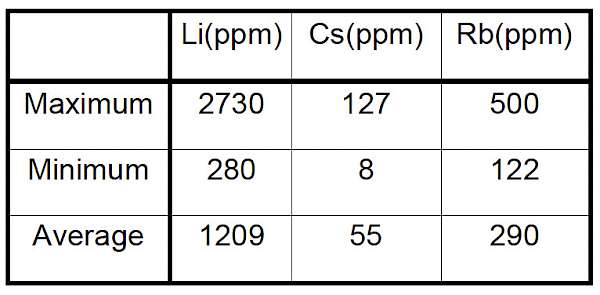

The data analyzed is from 7 phases of drilling spanning 7 years (2016-2023) and includes 91 core holes and 3,407 assayed intervals. Of these assays, 1,267 with greater than 1,000 ppm Lithium and over a minimum 15-foot thickness were selected as being the most likely to be mined due to their high grade and location. A summary of these assays is given in Table 1.

Table 1. Summary of Results

Discussion

Current prices for rubidium and cesium (>99.5%) are approximately $US 3,327/oz and $US 2,873/oz (Shanghai Metals Market prices, August 16, 2025, VAT included), respectively. With the >1000 ppm Li claystone material containing 290 ppm Rb and 55 ppm Cs, these metals have the potential to significantly enhance the value of the Zeus deposit.

Their economic value can be high per kilogram, especially for high-purity forms used in precision electronics or medical applications. Economically, producing these minerals as by-products from existing mining operations can be highly profitable, especially when market conditions favor increased demand and limited supply.

“These high-value, critical elements are essential in advanced electronics, telecommunications, and medical technologies, offering our shareholders a unique opportunity to participate in the supply chain for these vital commodities. Their occurrence as valuable by-products not only increases the project’s overall profitability but also positions us as a key player in the domestic critical minerals market. This development underscores the project’s potential to deliver substantial value for investors, supporting U.S. strategic priorities while creating long-term growth opportunities” commented Sandy MacDougall.

ON BEHALF OF THE BOARD OF DIRECTORS

Sandy MacDougall

Chariman & Director

Website: www.noramlithiumcorp.com

About Noram Lithium Corp.

Noram Lithium Corp. (TSXV: NRM | OTCQB: NRVTF | Frankfurt: N7R) is focusing on advancing its 100%-owned Zeus Lithium Project located in Clayton Valley, Nevada an emerging lithium hub within the United States. With the upsurge in the electric vehicle and energy storage markets the Company aims to become a key participant in the domestic supply of lithium in the United States. The Company is committed to creating shareholder value through the strategic allocation of capital.

Qualified Person

The technical information contained in this news release has been reviewed and approved by Brad Peek, M.Sc., CPG, who is a Qualified Person as defined by National Instrument 43-101 Standards of Disclosure for Mineral Projects, and Vice President of Exploration for Noram.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Cautionary Statement Regarding Forward-Looking Information

This news release may contain forward-looking information which is not comprised of historical facts. Forward-looking information involves risks, uncertainties and other factors that could cause actual events, results, performance, prospects and opportunities to differ materially from those expressed or implied by such forward-looking information. Forward-looking information in this news release includes statements regarding, among other things, plans for ongoing development of the Zeus Lithium Project. Factors that could cause actual results to differ materially from such forward-looking information include, but are not limited to, regulatory approval processes, results of further exploration work, and availability of capital on terms acceptable to the Company. Although Noram believes that the assumptions used in preparing the forward-looking information in this news release are reasonable, including that all necessary regulatory approvals will be obtained in a timely manner, undue reliance should not be placed on such information, which only applies as of the date of this news release, and no assurance can be given that such events will occur in the disclosed time frames or at all. Noram disclaims any intention or obligation to update or revise any forward-looking information, whether as a result of new information, future events or otherwise, other than as required by applicable securities laws.