Noram Reviews Global Lithium Supply And Demand As Context For Developing The Zeus Lithium Claystone Deposit

Click here for German verion of News Release

Vancouver, British Columbia – July 23, 2020 – Ahead of Noram Ventures Inc. (“Noram”) (TSX - Venture: NRM / Frankfurt: N7R / OTCPINK: NRVTF) drill campaign and engineering/economic studies in Q3/Q4 2020, management would like to summarize the current environment for global lithium supply and demand. Noram’s Zeus lithium claystone deposit has, at a 900 ppm lithium cut-off, 124 million tonnes at 1136 ppm lithium as indicated resources, and 77 million tonnes lithium at 1045 ppm lithium as inferred resources (0.75 and 0.43 million tonnes lithium carbonate equivalent – “LCE” , respectively; see Noram press release February 5, 2020, and Peek and Barrie, 2019: NI43-101 report on Zeus lithium claystone deposit: www.noramventures.com/projects/clayton-valley/technical-report/). The deposit is at surface and to a depth of 60-100 meters in unlithified claystone material. There are over two square kilometers of fertile ground yet to be drill-tested on the Zeus property.

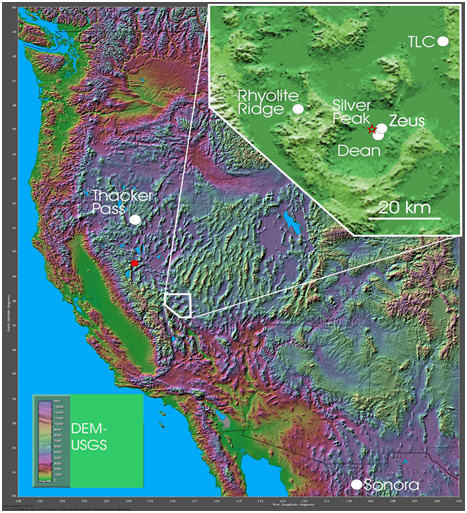

Figure 1. Location of six major lithium claystone deposits in the western USA and northern Mexico including Noram Ventures’ Zeus lithium claystone deposit in Clayton Valley Nevada. The Silver Peak lithium brine operations are shown as a red star in the inset map. The Tesla Gigafactory next to Sparks, Nevada is shown as the red box in the main map.

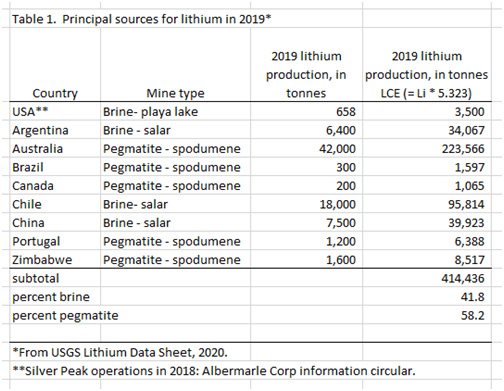

Lithium Supply - Global lithium resources are present in brine, pegmatite and claystone deposits. In 2019, there were only twelve lithium operations of significance globally. The USGS reports that “six mineral operations in Australia, two brine operations each in Argentina and Chile, and one brine and one mineral operation in China accounted for the majority of world lihiuim production (Table 1). Owing to overproduction and decreased prices, several established lithium operations postponed capacity expansion plans. Junior mining operations in Australia, Canada, and Namibia ceased production altogether.” /1/

In North America, the sole lithium producer is Albemarle’s Silver Peak brine operations, which have been in production for over 60 years (~3500 tonnes lithium carbonate equivalent (LCE) produced in 2019: table 1). Silver Peak is surrounded by a number of lithium claystone deposits that are poised for expansion and development, including Noram’s Zeus project, Cypress Development’s TLC project, Ioneer’s Rhyolite Ridge project and American Lithium’s TLC project. Two other lithium claystone deposits of significance are in the Cordillera of the USA and Mexico: Lithium America’s Thacker Pass Project and Bacanora’s Sonora project (Figure 1).

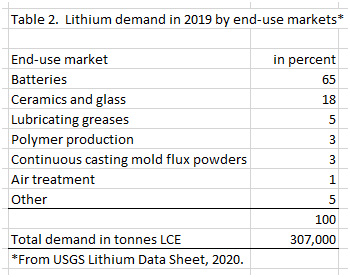

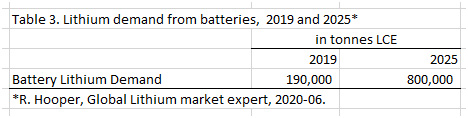

Lithium Demand - The USGS estimates that global end-use markets for lithium in 2019 are as follows: batteries 65%, ceramics andglass 18%, lubricating greases 5% polymer production 3%, continuous casting mold flux powders 3% air treatment 1% and other uses 5%. Global lithium consumption in 2019 was estimated to be 57,700 lithium metal or 307,000 tonnes LCE (table 2). Rodney Hooper (2020-06 - /2/) , a global lithium expert states that “Lithium demand from batteries is set to grow to >800,000 tonnes LCE by 2025 from a base of ~190,000 tonnes LCE in 2019. The majority of that growth will be driven by electriv vehicles (EV) powered by tier 1 batteries with long-dated warranties.” Hooper continues, “Unexpected EV “under demand” in 2019/2020 has resulted in oversupply; however, through a combination of government incentives, penalties & model launches in key auto segments, 2021 & 2022 should deliver unprecedented demand growth.”

C. Tucker Barrie, President and CEO of Noram Ventures Inc., comments: “Experts like Ronald Hooper concur with the major banks (e.g., J.P. Morgan, Deutchebank, Goldman Sachs, others) that the global lithium demand is effectively controlled by the demand for electric vehicles, and that the demand for EVs will increase threefold in the next five years. Although there is spare production capacity in the larger lithium sources, it appears that in late 2022 to early 2023 the supply will not meet this rapidly increasing demand, and this high demand will only increase in the following decade.

Tesla alone plans produce ~400,000 electric vehicles ths year, and aims to produce >2,000,000 electric vehicles in 2025. Each electric vehicle battery pack uses ~50-80 kg lithium carbonate equivalent. There are ten other major auto producers ramping up production for electric vehicles globally. We look forward to further exploration and development of our Zeus lithium claystone deposit in Nevada.”

/1/ USGS Lithium Data Sheet 2020

/2/ Rodner Hooper https://www.linkedin.com/in/rodneyhooper/

The technical information contained in this news release has been reviewed and approved by C. Tucker Barrie, Ph.D., P. Geo. who is a Qualified Person with respect to Noram’s Clayton Valley Lithium Project as defined under National Instrument 43-101.

About Noram Ventures Inc.

Noram Ventures Inc. (TSX - Venture: NRM / Frankfurt: N7R / OTCPINK: NRVTF) is a Canadian based junior exploration company, with a goal of developing lithium deposits and becoming a low - cost supplier. The Company’s primary business focus since formation has been the exploration of mineral projects. Noram’s long term strategy is to build a multi-national lithium minerals company to produce and sell lithium into the markets of Europe, North America and Asia.

Please visit our web site for further information: www.noramventures.com

ON BEHALF OF THE BOARD OF DIRECTORS

/s/ “C. Tucker Barrie, Ph.D., P. Geo.”

President and CEO

Office: (604) 553-2279

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release. This news release may contain forward-looking information which is not comprised of historical facts. Forward-looking information involves risks, uncertainties and other factors that could cause actual events, results, performance, prospects and opportunities to differ materially from those expressed or implied by such forward-looking information. Forward-looking information in this news release includes statements regarding, among other things, the completion transactions completed in the Agreement. Factors that could cause actual results to differ materially from such forward-looking information include, but are not limited to, regulatory approval processes. Although Noram believes that the assumptions used in preparing the forward-looking information in this news release are reasonable, including that all necessary regulatory approvals will be obtained in a timely manner, undue reliance should not be placed on such information, which only applies as of the date of this news release, and no assurance can be given that such events will occur in the disclosed time frames or at all. Noram disclaims any intention or obligation to update or revise any forward-looking information, whether as a result of new information, future events or otherwise, other than as required by applicable securities laws.